How Many Hours a Week is Part-Time Employment in Florida?

The number of hours you work each week has little bearing on your rights as an employee in Florida. Whether a full-time or part-time employee, you have a right to be paid minimum wage or better for every hour you work. You should receive overtime pay when you work more than 40 hours in a single workweek unless you are an exempt employee.

Florida labor laws do not establish full-time or part-time employment status. The employer generally determines what constitutes full-time employment or part-time employment. Whether an employee is considered full-time or part-time does not change the application of federal and state law to wage and fringe benefit requirements.

In Florida, wage theft is common, especially among construction, roofing, and restaurant workers in Florida. If you feel like you are not being paid as the law requires, an experienced Tallahassee unpaid wages attorney at Cruz Law Firm, P.A., can protect your rights as an employee and pursue the full compensation you deserve.

Understanding How Many Hours is ‘Part-Time’ Employment in Florida

There is no law that defines part-time or full-time employment. The U.S. Bureau of Labor Statistics says its surveys show that workers who work less than 35 hours per week are part-time employees. Conversely, full-time workers work 35 hours or more per week, according to the BLS.

Under the Fair Labor Standards Act, hours worked by an employee ordinarily includes all the time during which an employee is required to be on the employer’s premises, on duty, or at a prescribed workplace.

The compensation an employee should receive and whether they are considered part-time or full-time depends on the number of hours they work.

Legal Definitions and Standards for Hours Worked

The Fair Labor Standards Act (FLSA) establishes minimum wage, overtime pay and recordkeeping requirements for private sector employers and in federal, state, and local governments. The Migrant and Seasonal Agricultural Worker Protection Act (MSPA) requires farm labor contractors, agricultural employers, and agricultural associations to pay workers the wages they are owed when they are due.

Under the FLSA, covered nonexempt workers are entitled to a minimum wage of $7.25 per hour unless they are covered by a state minimum wage that requires more. Florida’s minimum wage is $12 per hour as of September 30, 2023, or at least $8.98 an hour for tipped employees who regularly receives more than $30 a month in tips.

Florida’s minimum wage will increase by $1 each September with annual adjustments until it reaches $15 per hour in 2026. Beginning in 2027, Florida minimum wage laws require the minimum wage to be adjusted annually for inflation.

The second significant requirement of the FLSA is that after an employee has worked for 40 hours in a single workweek, they are due overtime pay at a rate not less than one and one-half times the regular rate of hourly pay. For example, after 40 hours in a regular workweek, an employee making $12 per hour begins to make $18 an hour.

A workweek is any fixed and regularly recurring period of 168 hours – seven consecutive 24-hour periods (days). It may be Monday-Friday, Tuesday-Saturday, etc. The FLSA does not require Florida employers to pay overtime pay for work on weekends or holidays unless the employee works overtime hours beyond 40 hours in the workweek on such days.

Hours Worked and Impact on Employment Benefits

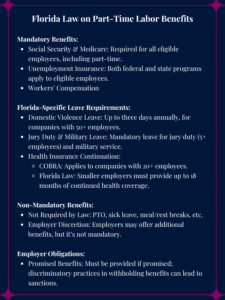

Federal law requires employers to provide certain benefits to their employees. Some benefits are only mandatory for companies over a certain size, while others are required for all employers. Employers and employees both contribute to certain programs, such as Social Security and Medicare insurance.

In almost all cases, eligible employees are entitled to:

- Social Security, which provide monthly payments to retired workers who reach a certain age and disabled workers and their dependents.

- Medicare pays the health costs of retired workers and people with long-term disabilities.

- Federal unemployment insurance, which supports workers who have lost their jobs under certain circumstances.

- State unemployment insurance, which is paid to employees who have been laid off.

- Workers’ compensation, which pays for medical treatment and lost income of workers injured on the job.

Florida law requires:

- Domestic violence leave of up to three days per year (required of organizations with more than 50 employees)

- Jury duty leave (organizations with five or more employees)

- Witness leave

- Military leave

- Civil Air Patrol leave (organizations with 15 or more employees)

- Healthcare continuation. The federal Consolidated Omnibus Budget Reconciliation Act (COBRA) requires organizations with 20 or more employees to offer health care insurance to employees who leave the organization in certain circumstances. The Florida Health Insurance Coverage Continuation Act has a legal requirement that employers with fewer than 20 employees must offer continued health care coverage for up to 18 months.

Employers can also offer voluntary benefits, but are not required to. Many workers are surprised to learn that they have no right to:

- Paid time off (PTO) or “vacation”

- Paid sick leave

- Meal breaks or rest breaks (except for minors)

- Health benefits

- Disability insurance

- Severance pay

- Retirement plans, i.e., employer-provided pensions or contributions to 401(k) funds.

The federal Family and Medical Leave Act (FMLA) allows certain employees to take up to 12 weeks of unpaid time off for eligible family and medical reasons. To be eligible, an employee must have worked 1,250 hours during the 12 months prior to the start of leave.

The Federal Affordable Care Act requires employers with 50 or more full-time equivalent employees (FTEs) to provide health insurance coverage to their full-time employees and their dependents.

Of course, employers are allowed to provide any nonrequired benefit they would like to their part-time workers and full-time employees. Many employers who offer generous benefit packages reserve them for full-time employees. Some benefits, such as company vehicles or stock acquisition programs, may be restricted to certain executive positions.

If your employer tells you your job comes with certain benefits and does not provide them as promised, they can be required to do so. An employer can also be compelled to make good on promised benefits and may be sanctioned due to discriminatory practices, such as withholding equal pay or benefits because of race, national origin, religion, age, or disability.

Contact Cruz Law for Legal Assistance and Advice

If your employer is not paying you wages or benefits as federal laws and Florida laws require, a labor law attorney at Cruz Law Firm may be able to help you pursue an unpaid wages lawsuit to recover the compensation you are owed. Your employer would also be responsible for your attorney’s fees and legal expenses.

An employer that has mistreated their entire workforce might be subject to a class action lawsuit.

An unpaid wages attorney at Cruz Law Firm in Tallahassee can help you gather records, complete required forms,, and meet filing deadlines to pursue a lawsuit over wage and hour violations.

It can be difficult to stand up to an employer who is treating you unfairly. But if you are not being paid properly at work, a wage and hour attorney with Cruz Law Firm will stand up for your rights. Our law firm can review your case and evaluate your legal options for pursuing compensation and accountability from your employer. The law is on your side if you are not being paid correctly.

Contact a Tallahassee unpaid wages lawyer with Cruz Law Firm today. Our attorneys represent hard-working employees like you in Tallahassee, Jacksonville, and across Florida.

Author: Cruz Law Firm P.A.

At Cruz Law Firm, P.A., we represent employees in Tallahassee, Jacksonville, and throughout the Florida Panhandle. We’ll fight to protect your employment rights, from workplace discrimination and sexual harassment to wrongful termination and whistleblower claims. Let us put our experience to work for you.